White House officials seem unsure they can limit the President’s movements. The Australian budget drops later today. And South Korean companies stay put in China. Here are some of the things people in markets are talking about today.

Going Home

President Donald Trump’s aides will try to keep him confined to the White House residence following his discharge from hospital, but are unsure they can limit his movements, according to people familiar with the matter. Trump urged Americans not to fear Covid-19 after receiving medical care including three powerful medicines and an airlift to the hospital. “Don’t let it dominate your life,” Trump tweeted Monday afternoon, before he walked out of the hospital unassisted. “We have developed, under the Trump Administration, some really great drugs & knowledge. I feel better than I did 20 years ago!” Trump’s physician Sean Conley said coronavirus patients can stop shedding the virus in as few as five days after diagnosis and that Trump would be monitored to determine when he is no longer infectious. The White House plans for Trump to stay in the residence for a few days before returning to normal, one of the people familiar with the matter said.

Asian stocks looked set to follow their U.S. peers higher amid optimism that President Donald Trump will leave the hospital and lawmakers will move closer to providing more stimulus. Treasury yields jumped and the dollar weakened. Futures pointed to modest gains in Japan, Australia and Hong Kong. U.S. stocks closed at the highest levels of the day rebounding from Friday’s swoon in the wake of Trump’s coronavirus disclosure. Energy, health care and technology shares were the biggest gainers in the S&P, pushing the benchmark index up by the most in almost four weeks. The longest-maturity Treasury yield surged to a three-month high as traders adjusted their election bets after Joe Biden’s latest poll numbers. Elsewhere, crude oil rebounded from a three-week low and gold advanced.

As the Australian government hands down its budget later Tuesday, infrastructure, energy, financial and retail stocks will likely be among those benefiting from the government’s budget plans that will boost spending to help lift the economy out of its first recession in almost 30 years. Treasurer Josh Frydenberg is expected to announce a A$220 billion ($158 billion) deficit when he hands down the budget, equivalent to 11.6% of gross domestic product, and stock investors are keenly waiting to see how the measures will support companies after they struggled through their worst profit season in a decade. Australian shares have failed to rally as much as some other regional markets after hitting an eight-year low in March amid Covid-19 restrictions. Here’s a list of factors to watch.

South Korea’s companies are reluctant to relocate home from China, despite the government’s best efforts to draw them back amid the pandemic and U.S.-China trade tensions. Only 80 firms — out of thousands — with links in China have returned part of their operations home since Korea introduced its “U-Turn” law in 2013 to stem the rising tide of overseas production, according to Korea Institute for Industrial Economics & Trade data. Even after the government extended its re-shoring subsidies to service-sector and IT firms earlier this year, the attractiveness of returning looks limited. It could be that firms considering cutting back operations in China are instead looking to relocate in Southeast Asia, suggesting Korea is missing an opportunity to bring back jobs, secure its supply chains and maintain domestic production competitiveness.

With the Covid-19 pandemic largely under control in China, the Golden Week holiday is putting on display the country’s confidence in its economic rebound and its public health measures. Through the first four days of the week-long holiday that started Oct. 1, some 425 million people traveled domestically, according to the Ministry of Culture and Tourism, nearly 80% of last year’s throngs. The surge of activity stands in stark contrast to the rest of the world — the global tourism industry is expected to lose at least $1.2 trillion in 2020 — and underscores the relative strength of China’s economic recovery. As of September, the OECD forecast a 1.8% expansion this year, putting China alone among the Group of 20 on pace to expand. Hotel prices have shot up, ride-hailing apps have crashed, tickets to the Great Wall sold out, and flight bookings are up 11% compared to 2019.

What We’ve Been Reading

This is what’s caught our eye over the past 24 hours:

And finally, here’s what Tracy’s interested in today

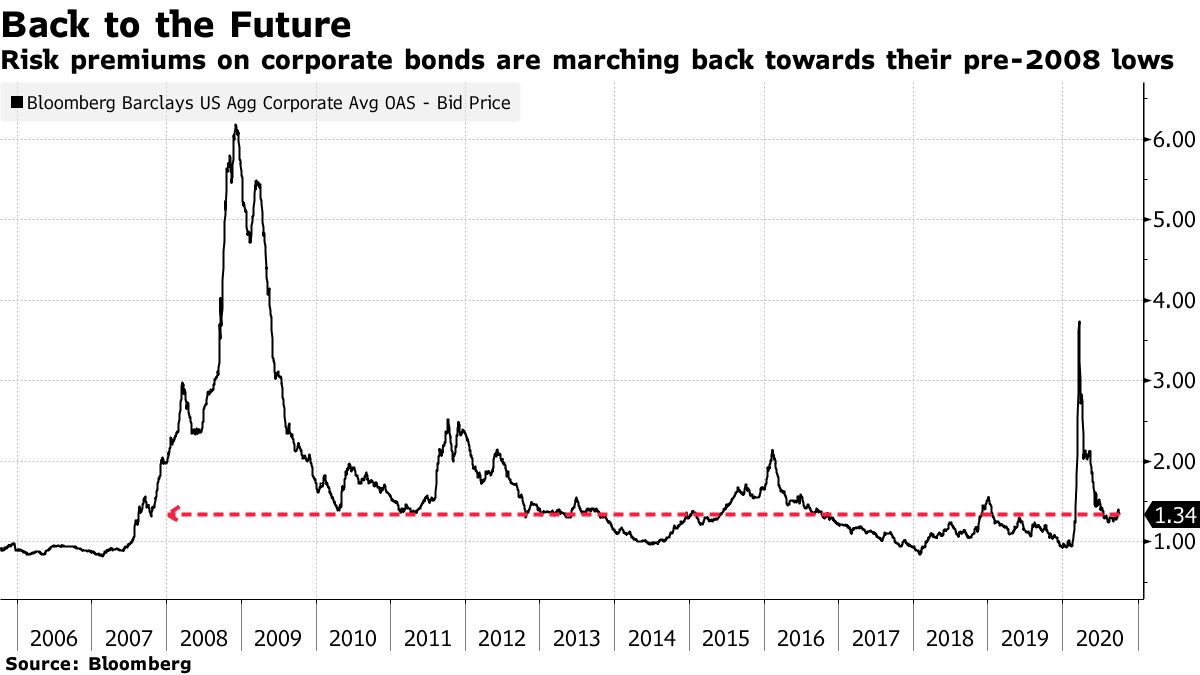

Where are we in the economic cycle? It’s a seemingly simple question, but one that has vastly different answers depending on where you look. Morgan Stanley’s Andrew Sheets says we’re at the early stages of an economic recovery, arguing that stock prices still have plenty of “skepticism” embedded in them and therefore could rise much further as the economy improves. But in many ways the credit market is already in late-cycle territory with the hallmarks of compressed returns and search for yield behavior.

Sales of new corporate debt are at record highs as companies take advantage of lower borrowing costs. Leveraged buyouts and M&A deals abound. Meanwhile, financial structures whose heyday can be traced back to before the 2008 financial crisis are enjoying a comeback. Bloomberg reported last week that Cerberus Capital Management is selling a package of commercial mortgages that, for all intents and purposes, very much resembles a CDO — part of the alphabet soup of securitizations that proliferated at the height of the last credit cycle. It’s the type of behavior that would normally make your average financial commentator declare “this is the top.” But, of course, if there’s one thing we’ve learned so far in 2020, it’s that nothing is normal.

You can follow Tracy Alloway on Twitter at @tracyalloway.

De-globalization or re-globalization? Following the pandemic, will companies move their supply chains out of China? Join us virtually on Oct. 6 at 1 p.m. Hong Kong/Singapore time (GMT+8) to hear insights from Australia & New Zealand Banking Group Executive International, Institutional Farhan Faruqui, U.K. Trade Commissioner for Asia Pacific Natalie Black and FutureMap founder Parag Khanna. Register for free here to be a part of this live, interactive conversation, or to access all content on-demand at your convenience.