Introduction and Investment Thesis

MakeMyTrip (MMYT) is an online travel agency focused on the Indian market where the company offers a digital platform for customers to purchase tickets or make reservations for a variety of travel-related activities. As an example, the company’s solution allows customers to purchase airline tickets, bus tickets, rail/car tickets, as well as lodging and other experiences. The company’s network in India is very strong with over 77K domestic accommodations and an even stronger ex-India network with over 700K accommodations.

Initially, the company focused on the Indian expat market in the US and servicing those customers who were looking for airfare between India and the United States. This has shifted since then and the company has now become much more of an India-focused play with a strong focus on domestic travel. This is part of my longer-term bullishness on the company. According to research from the Australian Financial Review, nearly 41% of India’s population is expected to become middle class by 2025. By becoming middle class, I believe that the Indian population, in general, will have more disposable income to spend on a variety of products and experiences. Travel is a key anchor to this and I expect that MakeMyTrip will be a strong beneficiary of this growth in the Indian middle class over the longer-term.

Furthermore, I do like the company’s diversified offerings that covers everything from airfare to lodging. This helps mitigate certain sector related risks. As an example, even if macroeconomic conditions caused air travel to decline, it may be made up by bus tickets. This helps provide a greater level of revenue stability to the cyclical travel end-market.

I also do like what the company is doing in becoming more than just a “broker.” As an example, the company has put significant effort into developing artificial intelligence solutions including chatbots. These chatbots not only help improve margins for the business through a reduction in more expensive human support staff, but it also allows for more responsive customer service for users of the MakeMyTrip platform. Customers have generally been happy with the chatbot based approach. This is a key differentiator that I believe will allow the company to gain share over time.

The company also has a strong loyalty program that I believe helps prevent user churn and helps increase the company’s customer lifetime value. These loyalty programs are based on consumer spend where the customer gets discounts based on continuing utilization of the MakeMyTrip platform.

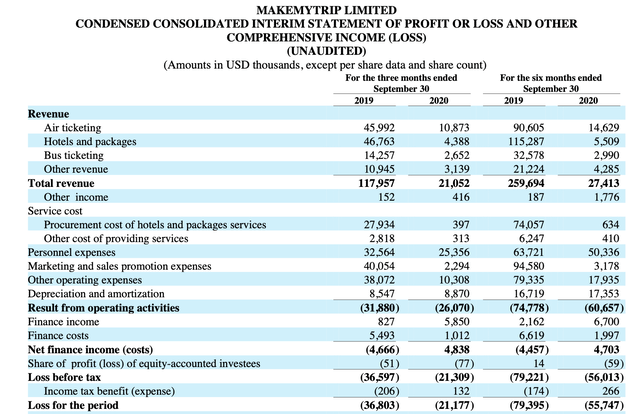

From a financial perspective, the company remains highly affected by COVID with revenues in 2020 a significant decline vs 2019 as seen below. However, given the crisis, the company has significantly cut expenses and net income losses have decreased on a YoY basis. With around $168 million of cash on the balance sheet, I believe that the company is well-capitalized to manage through this crisis.

Risks

Like many other companies in the travel sector, the company was negatively impacted by COVID related restrictions and quarantine orders. Recent vaccine news is a definite positive. However, it is unclear the level of vaccine uptake and more importantly the true trajectory of the pandemic. Unless we get closer to the end of the crisis, it is harder to say when consumers will get more comfortable with traveling. Thus I believe that COVID will continue to have a negative impact on the company’s trajectory at least for the next few quarters.

The market that MakeMyTrip plays in is also highly competitive with many scaled players including Booking.com, Expedia, and Yatra. However, I believe that MakeMyTrip has a strong footprint in India that the other foreign brands do not necessarily have. The Indian market is also large enough, similar to the US market, for multiple companies to succeed including MakeMyTrip.

Valuation and Conclusion

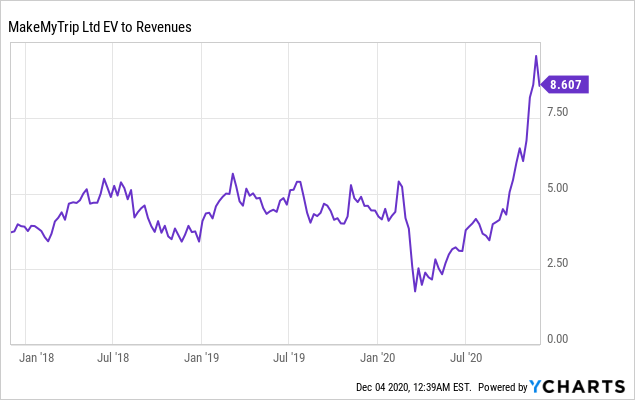

Looking at the company’s valuation, the company’s EV/revenue multiple has rebounded quite sharply to the ~8x range vs the historical ~5x range and is baking in at least a near-term recovery in travel volume. However, this is based on an enterprise value of $2.4B and TTM revenues of $280 million. This TTM revenue number is at a significant discount to the $511MM in revenues the company earned in the pre-COVID fiscal year ending March 2020. Thus, even assuming we get back to the same $511 million revenue level and applying the same historical 5x multiple, we only get to $2.6B in EV. This presents barely 10% of upside from these levels and assumes that we get back to the $511 million revenue level relatively quickly. That is far from certain as it will likely take some time for travel to ramp back up post-pandemic. Thus, I believe the stock is fully valued at this time and I am neutral on this name.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.