When you’re looking for an investment with explosive growth potential, small-cap stocks are often the best bet. However, they are risky. And risk is the last thing you want in retirement stocks — at least not when retirement is nearing instead of being far, far on the horizon.

That said, these seven retirement stocks are safe bets. They’re not start-ups, they have a proven business model and they offer stability. Each is picked because they are also well-positioned to take advantage of current and developing trends. Using this strategy, even though you are being conservative, your portfolio will continue to grow in value.

Additionally, each of these stocks pays a dividend. And that’s important because you can use those dividend payments as income during retirement.

So, with all of that in mind, these are the seven names we are taking a closer look at.

- Bunge Ltd (NYSE:BG)

- Dicks Sporting Goods Inc (NYSE:DKS)

- Goldman Sachs BDC Inc (NYSE:GSBD)

- Polaris Inc (NYSE:PII)

- Rent-A-Center Inc (NASDAQ:RCII)

- Southern Copper Corp (NYSE:SCCO)

- Target Corporation (NYSE:TGT)

Now, let’s dive in and take a closer look at each one.

Retirement Stocks to Buy: Bunge (BG)

Source: margouillat photo / Shutterstock.com

Bunge is an American agribusiness and food processing company with a long history. With roots dating back over 200 years, Bunge has grown to a multinational giant. It is one of the world’s largest producers of edible oils and margarine. Other products include milled grain products (sold to restaurants, commercial bakeries, food processors, and retailers), animal feed ingredients and bioenergy products.

Food products — especially the raw ingredients — are a solid bet for ongoing demand. There are never fewer people, and even if food fads or preferences change over the years, the same raw materials (like those produced by Bunge) will always be in demand. In addition, with pressure on fossil fuels, the market for biofuels is projected to more than double to $307.01 billion by 2030.

After several down years, BG stock has posted growth of 102% over the past 12 months.

Bunge has an “A” rating in Portfolio Grader. Its dividend yield is 2.4%.

Dick’s Sporting Goods (DKS)

Source: Jonathan Weiss / Shutterstock.com

Don’t count out retail when it comes to retirement stocks. Yes, there have been some casualties with the pandemic resulting in temporary store closures. But Dick’s Sporting Goods was able to capitalize on the public’s demand for home exercise and outdoor fitness equipment. The company’s same-store sales grew 10% in 2020. In addition, Dick’s had invested in e-commerce before the pandemic. That paid off with online sales doubling last year.

DKS stock has seen several periods of extended gains. Major growth cycles took place from 2002 through 2007 and from 2009 through 2014. With a burst of 208% growth over the past 12 months, it looks as though DKS stock is entering another growth cycle. This may be a big one as sports catch up to a year of pandemic disruption.

Dicks Sporting Goods has an “A” rating in Portfolio Grader and offers a 1.5% dividend yield.

Retirement Stocks to Buy: Goldman Sachs BDC (GSBD)

Source: Volodymyr Plysiuk / Shutterstock.com

When Goldman Sachs BDC went public in 2015, its IPO valued the business development company at $707.6 million. Today, Goldman Sachs BDC has a market capitalization of $1.97 billion. Goldman Sachs BDC has a focus on lending to middle-market companies — those that tend to grow the fastest. An investment in GSBD stock means your portfolio will reap some of the reward of these high-growth companies, while avoiding the risk of direct exposure.

That combination makes GSBD stock a solid pick for retirement stocks.

Goldman Sachs BDC has a dividend yield of 8.3% and earns an “A” rating in Portfolio Grader.

Polaris (PII)

Source: Ken Wolter / Shutterstock.com

Powered recreational vehicles are popular, especially in North America. Polaris is an industry leader, offering a wide range of off-road vehicles, including ATVs, UTVs, snowmobiles, boats, the three-wheeled Slingshot autocycle and the Indian Motorcycle brand. The company has products aimed at the casual recreation, hunting, farming and large property, cottage, racing and special purpose (such as park ranger or law enforcement) markets.

The demand for these vehicles has been healthy and is projected to increase at a steady clip. The global power sport market was worth over $34 billion in 2020, and it’s on track to exceed $50 billion by 2027.

Polaris is staying on top of trends, including electrification. The company is releasing an all-electric Ranger UTV in December, and plans to have an EV option for every class of vehicle in its lineup by 2025.

Over the past 12 months, PII stock has posted growth of 136%. Don’t expect that kind of return on a regular basis, but with outdoor recreation only increasing in popularity, this is a company with solid prospects. Polaris has an “A” rating in Portfolio Grader and its dividend yield is 1.7%.

Retirement Stocks to Buy: Rent-A-Center (RCII)

Source: David Tonelson/Shutterstock.com

When considering retirement stocks, it helps to look for trends that don’t change. One of those trends is consumers who want big ticket items for their home, despite lacking the cash on hand to pay for them outright. Items like furniture, electronics and appliances. Many of these people are worried about being locked into long-term contracts. Some aren’t able to qualify for a credit card.

That’s where Rent-A-Center comes in. The company offers lease to own plans for all of these products. The customer pays a monthly rental fee that includes delivery and service, eventually owning the item. But they also have the flexibility to stop payments at any time (returning the item) without penalty.

With the ever-increasing gig economy where employment income isn’t guaranteed, services like Rent-A-Center are likely to become even more popular. Strengthening its position, Rent-A-Center recently acquired rival Acima Holdings, adding its more than 15,000 retail partners.

Rent-A-Center has an “A” rating in Portfolio Grader, with a 2.2% dividend yield. RCII stock has posted a gain of 198% over the past 12 months.

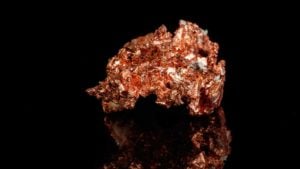

Southern Copper (SCCO)

Source: Coldmoon Photoproject/Shutterstock.com

Copper used to be considered a useful but and plentiful cheap metal — that’s why the penny was originally a copper coin. However, copper has become increasingly critical to modern life. Copper conducts heat and electricity very well, making it central to all things electric. It’s also used extensively in plumbing and other elements of construction. The demand and price just keep rising, which is why copper thefts at construction sites have become endemic. The FBI actually classified these copper heists as a threat to U.S. critical infrastructure.

In February, Goldman Sachs warned of a historic shortage of copper, citing demand from China and by green initiatives.

Southern Copper is the world’s fifth largest producer of copper. Adding SCCO stock to your investment portfolio lets you profit from the surging demand for copper. A demand that is going to continue for the foreseeable future.

Southern Copper has an “A” rating in Portfolio Grader, and its dividend yield is 3.2%.

Retirement Stocks to Buy: Target (TGT)

Source: jejim / Shutterstock.com

With lockdowns and store closures, last year was a brutal one for retailers. We also saw bankruptcies among iconic department stores. Target was a bright spot in the retail sector, and its success had a lot to do with the company’s foresight in investing in e-commerce capabilities.

Instead of struggling like many other retailers, Target had a blow-out year in 2020. The company reported its digital sales grew by $10 billion in 2020. That contributed to an overall 2020 sales growth of $15 billion that Target says was larger than its total sales growth over the prior 11 years combined.

Since 2019, TGT stock is up 210%. That’s pretty amazing especially for a large, established company. That’s the trajectory you want to see in your retirement stocks.

Target has an “A” rating in Portfolio Grader with a 1.3% dividend yield.

On the date of publication, Louis Navellier had a long position in BG, DKS, SCCO, and TGT. Louis Navellier did not have (either directly or indirectly) any other positions in the securities mentioned in this article. The InvestorPlace Research Staff member primarily responsible for this article did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

Louis Navellier, who has been called “one of the most important money managers of our time,” has broken the silence in this shocking “tell all” video… exposing one of the most shocking events in our country’s history… and the one move every American needs to make today.